Let's be more positive as life is ups and down, no one can control the economic recession from happening or predict the security of our jobs. What we can do is start preparing ourselves to face the economic recession by making planning to survive.

Whatever is going to happen will keep happening, bad or good is always in its way, what we need to do is to focus on what we want and what can we gain to make our life not too difficult when we turn older.

My Future Is My Choice, Your Future Is Your Choice

I have been wondering for years, what amount of money should I have when I reach 55, is the amount good enough for me to survive for the next 10 to 20 years or even 30 years? Not sure how long, we will live in good health too. But what I know, at 55, I want to have freedom in life, and debts free, avoid headaches dealing with people, have my own sweet time, have days without rush, and can travel here and there whenever I want.

So, what are my plans?

Yes, I start saving my money in a very simple and less risk.

How and What I have Planned For My Retirement

The experience during the recession that happen in 1998, make me alert that I should start planning for saving to ensure that I have a peaceful and calm retirement at the age of 55. But I don't really start that real early since my kids are young and too much of expenses to cover.

Since 2006, I start saving between 5% to 10% by splitting into two different bank accounts. One account is for daily expenses and another account I call it emergency account. So the emergency account is my saving for my retirement. I even save a much higher amount when receiving year-end bonuses.

When we save early as possible for retirement, we can enjoy the interest from the initial savings that will increase every year and we will be able to reach our savings target faster.

Before we make any savings, we also should know our commitment, our lifestyle, our spending, and, of course, our own expectation. Everyone has different retirement planning but somehow we need to start as early as we can.

The emergency account that I save is to ensure it is sufficient to cover living costs that are getting high each day, for food, and financial commitments such as personal loans, housing loan, car loan, child support, and others cost.

In fact, I made a good decision in canceling my credit cards years ago!

Besides having an emergency account, I do some investments in ASB, Gold investment, and I would recommend anyone to do the same. If you need my advice, do let me know

If you have extra, consider subscribing to investment-linked insurance or Takaful plan that can protect you while helping you save and provide investment opportunities. The plans give you an investment opportunity to increase the cash value of your certificate.

Thank you to my parent who taught me to save money in a piggy bank when we were small, and this is what I have been doing until now too. I keep and save RM5 and RM10 notes in different boxes every day and these are the extras I send to my emergency account almost every month.

Another thing I have done is cut down on unnecessary expenses in ensuring to remain resilient during an economic downturn. This does not mean that I have put aside all the comforts of life, there are various ways to reduce expenses without having to compromise the standard of living

The best part is that I challenged myself not to shop luxuriously but then I reward myself at the end of the year. Yes, that is the drastic change I have succeeded till now.

Last but not least, please make a budget for yourself and your family, and don't neglect food and drink.

What Amount Should You Have During Retirement

I read an article in Employee Provident Fund (EPF) portal, that a person's retirement savings should have a minimum of RM240,000 to fund from 55 to 75 years old.

Let's say you have that RM240,000 to survive for 20 years, would you know how long can that amount last? Will your expenses only cost you RM1,000 per month?

Whatever it is, that varies depending on each and everyone's commitments. You know your own expenses.

Even though I somehow prepared and secured, have expenses planned for retirement but I never stop looking for ways to increase my saving, calculating in the best way and I found this saving calculator good for any of us who have not started yours.

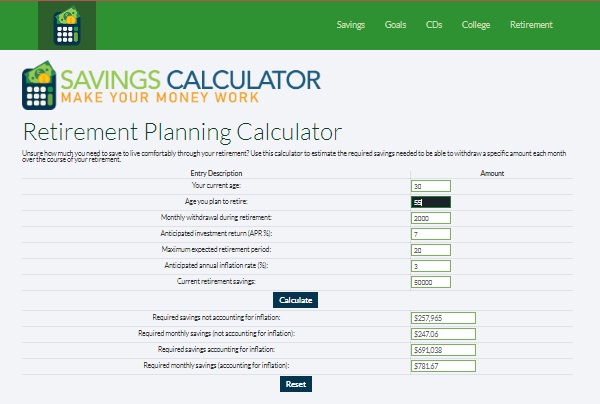

This saving calculator is good to help you to do planning on Savings, Goals, CDs, and or College Savings and I found that the Retirement Calculator is awesome for me.

Retirement Planning Calculator On Savingcalculator.org

What you will get is the estimated saving that you should save every month and the result of these savings to be enjoyed during your retirement.

It's so easy and friendly and it's really helpful for anyone who has no idea what to save for retirement.

Using the predicted data in the previous calculator, input your monthly expenses below for further clarification on how much you would need during retirement and your yearly savings.

The calculator estimation is good and it will help to give you a good assessment of where you stand in your savings progress, by combining those annual spending estimates with projections. Most thorough calculators bake in assumptions that are based on research: There will be defaults for inflation projections, life expectancy, and market returns.

I really recommend you try this calculator that will help you without giving you a headache to think much. Good luck!

My advise is please start your retirement planning to avoid you retiring without having enough money to cover your daily needs. After all, you have to want to have fun too, right, so you should save for that.

.jpg)

0 Comments

Terima kasih atas kunjungan dan komen, sungguh sangat dihargai! Kalau ada kesempatan saya akan balas, InsyaAllah. Komen baik-baik tau!

Thanks for the visit, appreciate your positive comments!